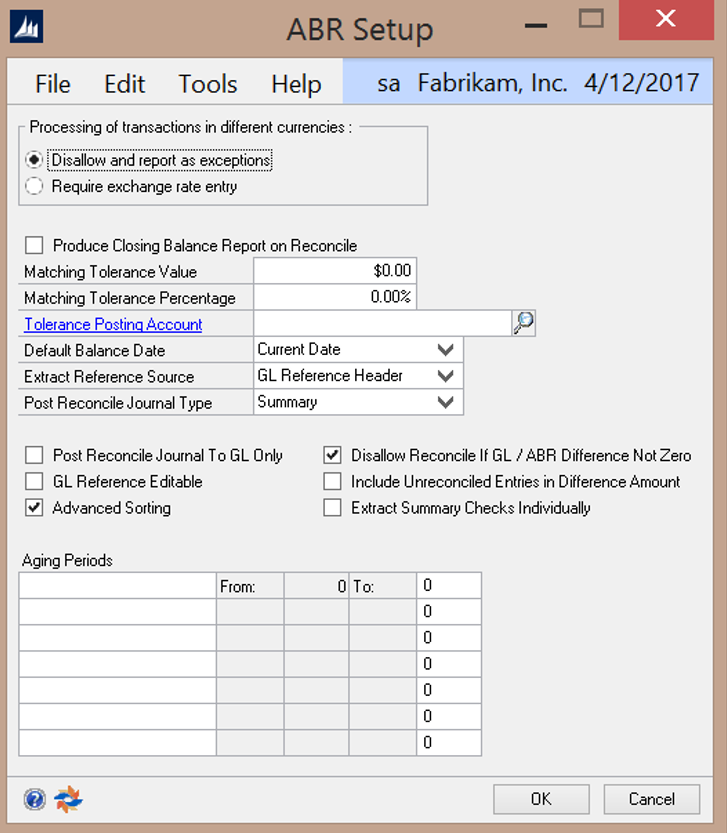

The ABR Setup window is used to setup the basic functionality of ABR.

Location

Tools >> Setup >> Financial >> Advanced Bank Reconciliation >> ABR Extract Options

Layout

Overview

The ABR Setup window is used to define company level settings. If multi-currency will be used in bank reconciliations, then select the Require Exchange Rate Entry option under Processing of Transactions in Different Currencies. Tolerances can be setup to create more flexible matching limits. Aging periods can be defined for use in the Aged Transactions report, to more clearly show the relative age of any un-reconciled transactions.

Fields

Processing of transactions in different currencies – Select the appropriate option for handling multi-currency transactions during the GL Extract process.

- Disallow and report as exceptions – Choose this option to have ABR report errors when attempting to process transactions in varying currencies.

- Require exchange rate entry – Choose this option to allow for transactions in varying currencies but require the user to enter an exchange rate.

Produce Closing Balance Report on Reconcile – Check this option to have the Closing Balance report print after completing a reconciliation and to have it saved during the Reconcile process for use in printing the Closing Balance History report.

NOTE: This option must be checked prior to completing a reconciliation to be able to retrieve the Closing

Balance History report in the ABR Report window.

Matching Tolerance Value – Enter in the dollar value variance that a GL transaction may have to be considered a match for a bank statement transaction. (Optional)

Matching Tolerance Percentage – Enter a percentage variance that a GL transaction may have to be considered a match for a bank statement transaction. (Optional)

Tolerance Posting Account – Enter the GL Account where the difference between the GL transaction and bank statement transaction will post if using Matching Tolerance options. (Optional)

Default Balance Date – The default date populated in the reconcile window. This date can be changed during the reconcile process. Options are:

- Current Date

- End of Last Period

- End of Last Month

Extract Reference Source – Select the reference information to be displayed for the GL Transactions in the

Reconcile window. Options are:

- GL Reference Header

- GL Reference Line

- GL Account Description

GL Reference Editable – Check this option to allow the Reference field to be edited in the Reconcile window. When this option is not checked the reference field is read-only.

Advanced Sorting – Allows more sorting options in the Reconcile window.

Post Reconcile Journal To GL Only – This feature is only used when moving cleared GL transactions to a separate Reconciled account upon reconciliation. When this option is checked, then the reconciled transaction will be placed into a batch, NC_ABR. If this option is not checked, the reconciled transactions will be automatically posted to the reconciled account.

Disallow Reconcile if GL / ABR Difference Not Zero - This option specifies whether or not the user is allowed to reconcile the account when the difference between the GL and Bank Statement is not equal to zero. When this option is checked, the reconcile difference must equal zero. If this option is not checked the reconcile difference is not required to equal zero.

Include Unreconciled Entries in Difference Amount – When checked, any unreconciled bank entries are included in the difference amount. When unchecked, any unreconciled bank entries are excluded from the difference calculation.

Extract Summary Checks Individually – This option allows the ability to post AP computer checks to the GL in summary, but to retrieve the detailed transactions from the AP module for use in ABR.

Aging Periods – Defines the aging periods used on the Aged Transactions report.

Buttons

OK – Save the current settings and close the window

Cancel – Clear all changes and close the window