Customer and Vendor Payments

To automatically create and apply customer and vendor payments through ABR you will need to create the appropriate transaction templates.

Locate the "Transaction Templates" option in the navigation bar and select to create a new template.

Details

Ensure you select either “Customer Ledger” or “Vendor Ledger” as the transaction type

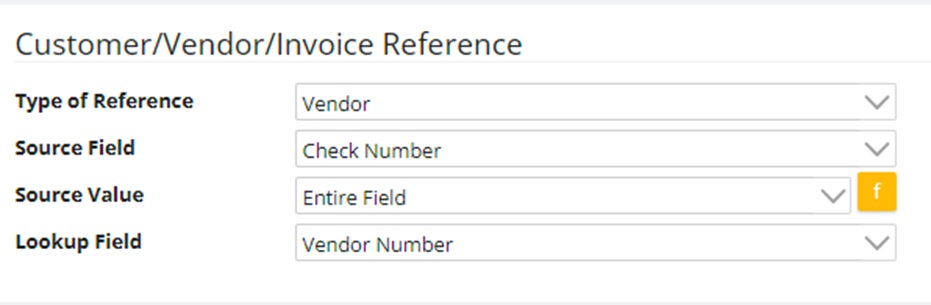

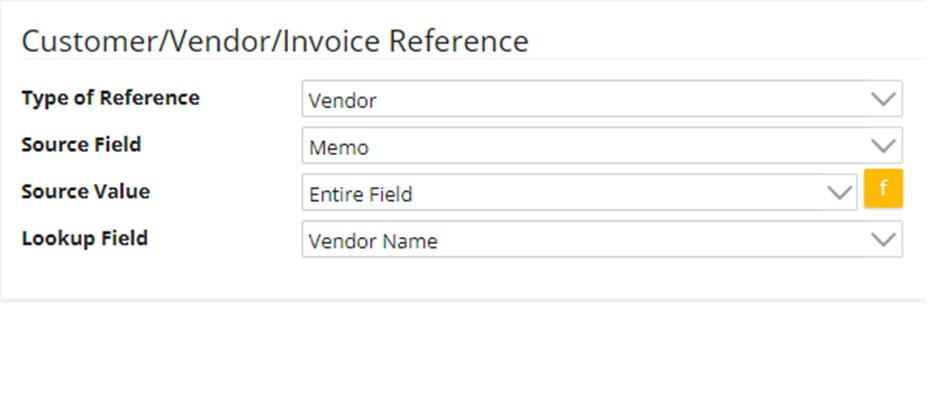

Customer/Vendor/Invoice Reference

Next you need to configure where the system can pull in the customer or vendor information.

Type of Reference

Vendor Customer

This indicates that somewhere in the statement transaction there is going to exist the information to identify the vendor/ customer to create the payment for.

Invoice

This indicates that we will be identifying the specific invoices that the statement transaction applies too. From the invoice(s) we will able to identify the vendor/customer to create the payment against.

Source Field

This is a list of fields on the statement transaction, pick the field that we will be pulling the above reference from.

Source Value

Entire Field

We will read the entire field to identify the customer/vendor or the invoice number.

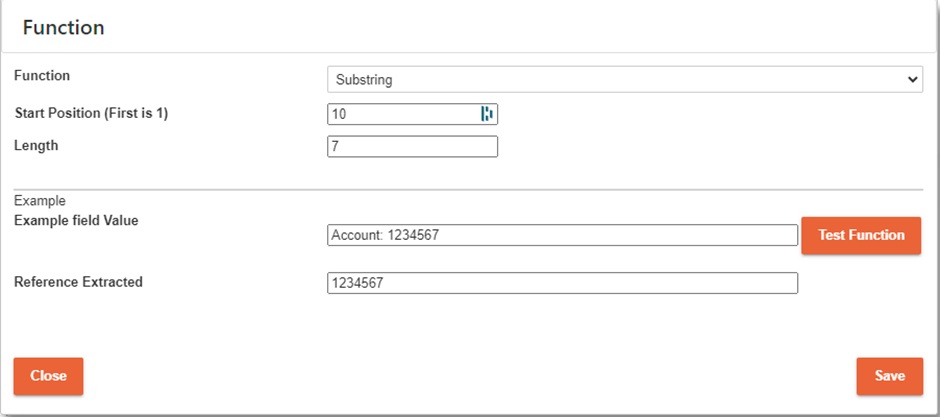

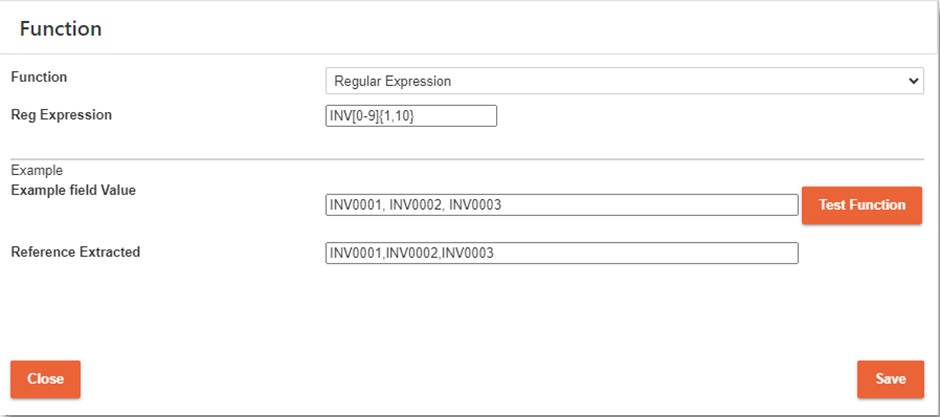

Function

This option allows us to define a function to pull out the reference information if it is, for example, only part of the field or there are multiple invoice references.

There are two functions available

- Substring

Here you can define a starting point and a length to cut a section out of the target string.

- Regular Expressions

Here you can define a regular expression to pull out the information we need. Regular expressions are a powerful tool for this type of string extraction but can be quite intimidating to get your head around for new users.

There are multiple resources on the internet to help you understand regular expressions, for example:

- https://regexone.com/

- https://www.codecademy.com/learn/introduction-to-regular-expressions

- https://learn.microsoft.com/en-us/dotnet/standard/base-types/regular-expression-language-quick-reference

Test Function

This section allows you to test the substring or regular expression you have just created to make sure it is functioning like expected.

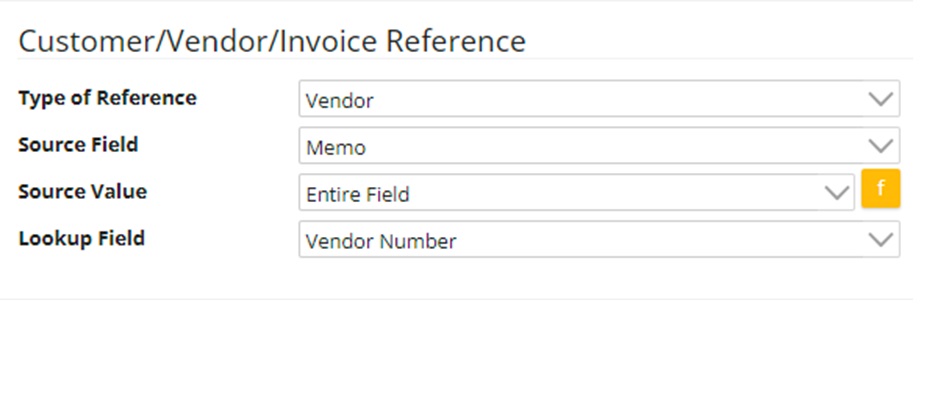

Lookup Field

This is the field on the customer/vendor card, or the invoice itself that we will check against. For example, if we want to extract the vendor number from the memo field and we know that the memo field just consists of the vendor number we can setup our options like so:

Or if we know we can extract the vendor name instead of the number we could do the following:

Apply Options

Here we can choose if we want to attempt to apply the payment we generate to an invoice. Our options here are dependent upon which reference type we have selected.

Apply Payment to Invoice

Simply tick this option if you want to apply payments to invoices.

Apply Method

For Customer/Vendor Reference:

- Match Newest – looks at all outstanding invoices for the customer/vendor and starts applying from the newest going backward until the whole amount is applied or we have run out of invoices to apply too.

- Match Oldest– looks at all outstanding invoices for the customer/vendor and starts applying from the oldest going forward until the whole amount is applied or we have run out of invoices to apply too.

- Match by Outstanding Amount – Looks at all invoices for the customer/vendor and selects the first it finds whose outstanding amount exactly matches the payment amount.

- Match by Invoice Amount - Looks at all invoices for the customer/vendor and selects the first it finds whose outstanding amount AND original invoice amount exactly matches the payment amount.

For Invoice Reference:

- Exact Invoices – attempts to apply against all the invoices identified in the reference selection, will keep applying against these invoices until there is nothing left to apply or no invoices left to apply against.

Field Mappings

Here you can select what information you want in the Reference and Transaction Date fields, you can pull this information from the statement fields or provide hard coded constant values for them.

Nominal Account Breakdown

Here you can define the transaction break down that will make up the payment. The default breakdown is one line going from the bank we are processing against, and one line against the vendor/customer we have identified.

You can add additional lines if you wish, the only thing you need to ensure is that the allocation percentage totals up to 0% (i.e. 100% allocated to one side, and -100% allocated to the other.

You can also define dimension templates to add to each line.